Wake Me, Shake Me

A quickening of events pulses through lands where for so long time stood still, and the oil - what's left of it - lies locked for the moment beneath hot sands - woe upon all ye soccer moms! - while Colonel Gadhafi ponders the Mussolini option - that is, to be hoisted up a lamp-post on a high-C piano wire until his head bursts like a rotten pomegranate. Then the good folk of Libya can fight amongst themselves for the swag, loot, and ka-chingling oil revenues he left behind. Meanwhile, Hillary Clinton scowls on the sidelines knowing how bad it would look if US marines actually hit the shores of Tripoli (and perhaps how fruitless it might turn out to be). And Italian grandmothers across the Mediterranean wonder why there's no gas to fire up the orecchiette con cime di rapa.

The fluxes of springtime run cruelly across the sands of Araby, clear into Persia where the ayatollahs' vizeers toy with uranium centrifuges and thirty million young people wonder how long they will allow bearded ignoramuses to tell them how to pull their pants on in the morning. Along about now, I wouldn't feel secure standing next to somebody lighting a cigarette in that part of the world.

Pretty soon we're going to find out just how fragile things are in the Kingdom of Saudi Arabia, there at the heart of things oily. Last week, King Abdullah wobbled out of his intensive care unit to spread a little surplus cash around the surging population, but let's remember that their share of the oil "welfare" has been going down steadily in recent years - a simple matter of numbers really. Putting aside even the common folk, a thousand princes from dozens of different tribes pace restively in the background awaiting the struggle that must follow King Abdullah's overdue transmigration to the farther shore. All along the western coast of the Persian Gulf and down toward the Horn of Africa, dark forces stir. Fuses sputter in Kingdoms from Bahrain to the Yemen.

Also last week, Wikileaks released papers signifying that Saudi Arabia's oil reserves were quite a bit less than they had claimed. It was basically an old story, one that the late Matthew Simmons had published in 2005 just from poring over reams of production data from the Saudi oil fields. The difference in the Wikileaks story was that this time a Saudi Arabian oil ministry official confirmed the story. You can bet they are going to have problems keeping the flow rate up. They can sell off some stored inventory for a few weeks, but after that the world will know the truth: Saudi Arabia is in depletion and the oil markets will never be the same.

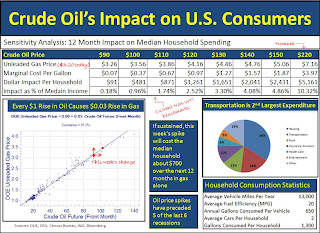

It hardly made an impression on a US public preoccupied with comings and goings of Charlie Sheen. President Obama wants to pretend that American life-on-wheels will just keep rolling along. He hasn't so much as hinted to the US public that the time approaches when gasoline will have to be rationed either by high prices or odd-and-even licenses plates or some other method. Charming fellow that he is, his fecklessness in the face of disintegrating oil markets will go down in history as something like Nero's musical solo while Rome burned down.

While these matters work toward deeper complication, Europe faces imminent rollovers of debt that can no longer be rolled over, and upcoming elections in Ireland and Germany that will begin to resolve an every-country-for-itself outcome for the debt follies of the EMU - and especially the big European banks, which may find themselves getting "haircuts" clear down to their jugular veins. Birds will be flipped to bond-holders and austerity will end up sounding like a kinder-and-gentler version of the gnarliness that really ends up happening.

By the way, for years I've proposed that the time would come when some of the European nations would not be able to depend entirely on the USA doing its dirty work in the Middle East to keep the oil flowing out. That time is now here. The café layabouts of Italy, the flaneurs of France, and the bratwurst-devourers of Germany may now have to militarize and get into the action in places where American boys have been bleeding out in the sand for decades. The truth is, we could stand some reinforcements. Something that smells an awful lot like World War Three is shaping up around the Mediterranean and spilling over toward the Indian Ocean. German cruisers are already out there plying the seas off North Africa while the ghost of Erwin Rommel scratches his head on the gritty shores of Tobruk.

Nobody knows how anybody is going to pay for World War Three, but perhaps it is in the nature of an historic crack-up blow-off that the accumulated treasure of generations just gets vacuumed out of every vault and hidey-hole to keep the pyre burning - fire being nature's preferred dry-cleaning agent. The fate of a few quadrillion credit default swaps contracts may end up as tomorrow's Flying Dutchman, a haunting enigma plying the vapors of eternity, sure to frighten juveniles of the marmoset-like humanoid creatures who succeed us up the evolutionary ladder.

Apparently nature likes to take its creations to the cleaners every so often, to clear the dross and detritus away. This is perfectly understandable, though one might prefer it happened to some other generation. The Baby Boomers were so effusive over the World War Two cohort because we probably thought we would never have to go through something like that ourselves. The Boomers expected nothing worse than a sequence of diminishing golf scores and blander meals as their horizons moved past assisted living to the final meet-up with God. Now, it turns out, we get to watch our grandchildren fight over the table scraps of the American Dream - such as it was: Chevies, burgers, reality TV, and all the mortgage obligations you could cram in the kitchen drawer.

It's coming on springtime and things are breaking loose all over the place. I give Saudi Arabia three weeks before it starts to blow up. And even Iran might get the fever. Plan on a staycation this summer and start thinking about that garden because it's not altogether certain that we'll keep up the conveyer belt of Little Debbie Snack Cakes and other staples of the American table into the supernarkets when diesel fuel hit $10 a gallon and the truckers stay home to watch the Kardashian girls. I'm already getting hungry.