Sunday, September 30, 2007

By David Eggert, Associated Press Writer

LANSING, Mich. — Two-thirds of Michigan's state government workers were told Friday not to report to work Monday as negotiations continued on a budget plan that could avert a partial state government shutdown.

Messages went to about 35,000 state workers, telling them they were being placed on a temporary layoff beginning at 12:01 a.m. Monday and not to go to work unless otherwise notified.

About 18,000 state employees will remain on the job, including 12,000 prison employees, said Liz Boyd, a spokeswoman for Democratic Gov. Jennifer Granholm.

"We will have limited state police," Boyd added.

A partial government shutdown could derail lottery sales, driver's license renewals and many other services the governor would deem non-essential in a fiscal emergency.

A Wayne County judge, however, on Friday gave the three Detroit casinos permission to stay open even if the state is unable to oversee them during a shutdown. The casinos contribute $1 million a day to state public schools and Detroit public safety, a casino spokesman said.

Members of the Granholm administration met with both House parties on Friday afternoon, raising hopes that a proposal was close to fill a $1.75 billion shortfall in the fiscal year that starts Monday.

Negotiations center on raising the state's personal income tax rate, now at 3.9%, to as high as 4.6%. Another key issue is extending the sales tax to some new services.

House members were told no budget deal votes were likely until later Friday. Legislative leaders and the Granholm administration were tight-lipped about possible progress.

Associated Press Writers Kathy Barks Hoffman and Tim Martin contributed to this report.

http://usatoday.printthis.clickabili...partnerID=1660

Saturday, September 29, 2007

Friday, September 28, 2007

What a scary situation. So is it easy to shut down the internet in a country?

http://www.guardian.co.uk/burma/stor...179427,00.html

Mark Tran and agencies

Friday September 28, 2007

Guardian Unlimited

The Burmese government apparently cut internet access today in an attempt to staunch the flow of pictures and messages from protesters reaching the outside world.

An official told the Agence France-Presse news agency that the internet "is not working because the underwater cable is damaged".

In Bangkok, in neighbouring Thailand, an official at a telecommunications firm that provides satellite services to Burma said some internet service inside the country had been cut.

The London-based blogger Ko Htike said: "I sadly announce that the Burmese military junta has cut off the internet connection throughout the country. I therefore would not be able to feed in pictures of the brutality by the brutal Burmese military junta."

5.30pm

Internet access cut off in Burma

Mr Htike said he would try his best to feed the Burmese junta's "demonic appetite of fear and paranoia by posting any pictures that I receive though other means ... I will continue to live with the motto that 'if there is a will there is a way'."

The US criticised the junta's move, with the White House spokesman, Scott Stanzel, saying: "They don't want the world to see what is going on there."

Only 1% of the population in Burma has internet access, but protesters have managed to send out videos, photographs and messages to keep the outside world abreast of the dramatic events unfolding in Burma for the past week.

Many images have been picked up by mainstream news organisations, because protesters have captured pictures that no one else has been able to, helping to fuel public outrage at the government's crackdown.

When Burma's opposition leader, Aung San Suu Kyi, who is under house arrest in Rangoon, stepped outside her home to greet marching monks and supporters last week, the only pictures were posted on blogs and later picked up by news organisations.

The Burmese junta has been caught unawares by the ingenuity of bloggers - mainly university students - who have been sending their material to Burmese exile websites in Thailand and India.

But in recent days they have turned their attention to preventing material collected by protesters and dissidents from getting out, shutting down internet cafes and now allegedly cutting internet links with the outside world. Journalists from Reuters, the Associated Press and AFP are still continuing to operate in Burma.

Even a partial internet shutdown in a country where service is sporadic at the best of times could reduce the number of photos and videos of the crackdown that have been transmitted.

According to Reporters Without Borders, Burma ranks 164 out of 168 states on press freedom. The group says: "The Burmese government's internet policies are even more repressive than those of its Chinese and Vietnamese neighbours ... It keeps a very close eye on internet cafes, in which the computers automatically execute screen captures every five minutes, in order to monitor user activity."

02/02/2007

Dear Soldiers, Sailors, Airmen, Marines, National Guard,Reservists, in Iraq , in the Mi ddle East theater, in Afghanistan! , in the area near Afghanistan , in any base anywhere in the world, and your families:

Let me tell you about why you guys own about 90 percent of the backbone in the whole world right now and should be happy with yourselves and proud of whom you are.

It was a dazzlingly hot day here in Rancho Mirage today. I did small errands like going to the bank to pay my mortgage, finding a new bed at a price I can afford, practicing driving with my new 5 wood, paying bills for about two hours. I spoke for a long time to a woman who is going through a nasty child custody fight. I got e-mails from a woman who was fired today from her job for not paying attention. I read about multi-billion dollar mergers in Europe! , Asia , and the Mideast . I noticed how overweight I am, for the millionth time. In other words, I did a lot of nothing.

Like every other American who is not in the armed forces family, I basically just rearranged the deck chairs on the Titanic in my trivial, self-important, meaningless way.

Above all, I talked to a friend of more than forty-three years who told me he thought his life had no meaning because all he did was count his money.

And, friends in the armed forces, this is the story of all of America today. We are doing nothing but treading water while you guys carry on the life or death struggle against worldwide militant Islamic terrorism. Our lives are about nothing: paying bills , going to humdrum jobs, waiting until we can go to sleep and then do it all again. Our most vivid issues are trivia compared with what you do every day, every minute, every second.

Oprah Winfrey talks a lot about "meaning" in life. For her, "meaning" is dieting and then having her photo on the cover of her magazine every single month (surely a new world record for egomania). This is not "meaning."

Meaning is doing for others.

Meaning is risking your life for hers

Meaning is putting your bodies and families' peace of mind on the line to defeat some of the most evil, sick killers the world has ever known.

Meaning is leaving the comfort of home to fight to make sure that there still will be a home for your family and for your nation and for free men and women everywhere.

Look, soldiers and Marines and sailors and airmen and Coast Guardsmen, there are six billion people in this world. The whole fate of this world turns on what you people, 1.4 million, more or less, do every day. The fate of mankind depends on what about 2/100 of one percent of the people in this world do every day and you are those people. And joining you is every policeman, fireman, and Emergency Medical Technician in the country, also holding back the tide of chaos.

Do you know how important you are? Do you know how indispensable you are? Do you know how humbly grateful any of us who has a head on his shoulders is to you? Do you know that if you never do another thing in your lives, you will always still be heroes? That we could live without Hollywood or Wall Street or the NFL, but we cannot live for a week without you?

We are on our knees to you and we bless and pray for you every moment. And Oprah Winfrey, if she were a size two, would not have one millionth of your importance, and all of the Wall Street billionaires will never mean what the least of you do, and if Barry Bonds hits hundreds of home runs it would not mean as much as you going on one patrol or driving one truck to the Baghdad airport.

You are everything to us, as we go through our little days, and you are in the prayers of the nation and of every decent man and woman on the planet. That's who you are and what you mean. I hope you know that.

Love,

Ben Stein

Thursday, September 27, 2007

Monday, September 24, 2007

UAW Launches National Strike Against General Motors; Union Head Says

"One-Sided" Talks Fail DETROIT (AP) -- Thousands of United Auto Workers walked off the job at General Motors plants around the country Monday in the first nationwide strike against the U.S. auto industry since 1976.

“It’s all smoke and mirrors. The financial system has decoupled from the productive elements of the economy and is now beginning to show disturbing signs of instability. That’s why the big blow-off in the bond market. The halcyon days of supplying our armies, funding our markets and building our subprime ‘ownership society’ empire on the backs of foreign creditors is over. The stock market is headed for the landfill and housing is leading the way. Economic fundamentals can only be ignored for so long . . . .”

Friday, September 21, 2007

Wednesday, September 19, 2007

By Ambrose Evans-Pritchard, International Business Editor

Last Updated: 7:29pm BST 19/09/2007

Saudi Arabia has refused to cut interest rates in lockstep with the US Federal Reserve for the first time, signalling that the oil-rich Gulf kingdom is preparing to break the dollar currency peg in a move that risks setting off a stampede out of the dollar across the Middle East.

"This is a very dangerous situation for the dollar," said Hans Redeker, currency chief at BNP Paribas.

"Saudi Arabia has $800bn (£400bn) in their future generation fund, and the entire region has $3,500bn under management. They face an inflationary threat and do not want to import an interest rate policy set for the recessionary conditions in the United States," he said.

The Saudi central bank said today that it would take "appropriate measures" to halt huge capital inflows into the country, but analysts say this policy is unsustainable and will inevitably lead to the collapse of the dollar peg.

As a close ally of the US, Riyadh has so far tried to stick to the peg, but the link is now destabilising its own economy.

The Fed's dramatic half point cut to 4.75pc yesterday has already caused a plunge in the world dollar index to a fifteen year low, touching with weakest level ever against the mighty euro at just under $1.40.

There is now a growing danger that global investors will start to shun the US bond markets. The latest US government data on foreign holdings released this week show a collapse in purchases of US bonds from $97bn to just $19bn in July, with outright net sales of US Treasuries.

The danger is that this could now accelerate as the yield gap between the United States and the rest of the world narrows rapidly, leaving America starved of foreign capital flows needed to cover its current account deficit -- expected to reach $850bn this year, or 6.5pc of GDP.

Mr Redeker said foreign investors have been gradually pulling out of the long-term US debt markets, leaving the dollar dependent on short-term funding. Foreigners have funded 25pc to 30pc of America's credit and short-term paper markets over the last two years.

"They were willing to provide the money when rates were paying nicely, but why bear the risk in these dramatically changed circumstances? We think that a fall in dollar to $1.50 against the euro is not out of the question at all by the first quarter of 2008," he said.

"This is nothing like the situation in 1998 when the crisis was in Asia, but the US was booming. This time the US itself is the problem," he said.

Mr Redeker said the biggest danger for the dollar is that falling US rates will at some point trigger a reversal yen "carry trade", causing massive flows from the US back to Japan.

Jim Rogers, the commodity king and former partner of George Soros, said the Federal Reserve was playing with fire by cutting rates so aggressively at a time when the dollar was already under pressure.

The risk is that flight from US bonds could push up the long-term yields that form the base price of credit for most mortgages, the driving the property market into even deeper crisis.

"If Ben Bernanke starts running those printing presses even faster than he's already doing, we are going to have a serious recession. The dollar's going to collapse, the bond market's going to collapse. There's going to be a lot of problems," he said.

The Federal Reserve, however, clearly calculates the risk of a sudden downturn is now so great that the it outweighs dangers of a dollar slide.

Former Fed chief Alan Greenspan said this week that house prices may fall by "double digits" as the subprime crisis bites harder, prompting households to cut back sharply on spending.

For Saudi Arabia, the dollar peg has clearly become a liability. Inflation has risen to 4pc and the M3 broad money supply is surging at 22pc.

The pressures are even worse in other parts of the Gulf. The United Arab Emirates now faces inflation of 9.3pc, a 20-year high. In Qatar it has reached 13pc.

Kuwait became the first of the oil sheikhdoms to break its dollar peg in May, a move that has begun to rein in rampant money supply growth.

Tuesday, September 18, 2007

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 4 3/4 percent.

Economic growth was moderate during the first half of the year, but the tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today's action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time.

Readings on core inflation have improved modestly this year. However, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

Developments in financial markets since the Committee's last regular meeting have increased the uncertainty surrounding the economic outlook. The Committee will continue to assess the effects of these and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Charles L. Evans; William Poole; Eric S. Rosengren; and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 50 basis point decrease in the discount rate to 5 1/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve banks of Boston, New York, Cleveland, St. Louis, Minneapolis, Kansas City and San Francisco.

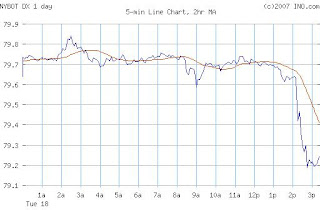

The dollar got hosed right after this announcement:

Monday, September 17, 2007

By Steven Bodzin

Sept. 17 (Bloomberg) -- Venezuelan President Hugo Chavez instructed Petroleos de Venezuela SA, the state oil company, to convert its investment accounts from dollars to euros and Asian currencies to reduce risk.

The decision may help weaken the dollar as the Federal Reserve prepares to lower interest rates this week, said Philip Wee, an economist at DBS Bank Ltd. in Singapore. The currency has fallen against 14 of the 16 most-active over the past year, partly as governments signaled they may diversify their holdings away from the U.S., the world's primary destination for reserves.

Venezuela moved some of its reserves into euros last year, along with other oil producers including the United Arab Emirates, Kuwait and Qatar. The $50 billion Qatar Investment Authority said Sept. 4 it was looking for options in Asia to counter a weak dollar. China is starting a fund to look for higher returns on some of its almost $1.4 trillion holdings.

``Central banks will be switching more of the dollar into other currencies,'' said Wee, senior currency economist at DBS. ``This should be another negative in a trend that's already set in the interest-rate outlook'' and the Fed may lower borrowing costs to 4.75 percent by year-end from 5.25 percent, he said.

Chavez, speaking in his weekly address on national television yesterday, said the U.S. has bought goods from around the world, paying with paper that is ``a bubble.'' The president said he instructed Energy and Oil Minister Rafael Ramirez to change currencies after the Fed increased the U.S. money supply to alleviate a shortage of cash sparked by concerns about debt backed by sub-prime mortgages.

Iran, China

The dollar traded at $1.3883 per euro at 7:20 a.m. in London from $1.3875 late in New York on Sept. 14. It reached $1.3927 on Sept. 13, the lowest since the single European currency was introduced in 1999. The dollar may weaken to $1.40 per euro by year-end, Wee forecasts.

The world's oil trading system has primarily used dollars for decades. Iran in July requested yen rather than dollars for all shipments to Japan, boosting that currency.

Petroleos de Venezuela had $23 billion in current assets, including $1.88 billion in cash, $848 million in restricted cash and $9.55 billion in accounts receivable, at the end of 2006, according to its audited financial statement. In addition, the company finances the national development fund known as Fonden, which held $27.3 billion as of May 11.

Chavez speaks frequently about the need to increase his country's independence from the U.S., which he calls ``the empire.'' He has sought to diversify his country's customer base for oil by signing supply contracts with Japan and China.

Oil Minister Ramirez said Sept. 11 that Venezuela and China will work together on a $10 billion project to build six refineries and a shipping company to make Venezuela one of China's most important suppliers. Still, the U.S. continues to import 1.36 million barrels a day of crude and refined products from Venezuela, more than half its estimated 2.4 million barrels a day of output.

To contact the reporter on this story: Steven Bodzin in Caracas at sbodzin@bloomberg.net .

http://www.bloomberg.com/apps/news?p...cPI&refer=news

Sunday, September 16, 2007

Alan Greenspan claims Iraq war was really for oil

AMERICA’s elder statesman of finance, Alan Greenspan, has shaken the White House by declaring that the prime motive for the war in Iraq was oil.

In his long-awaited memoir, to be published tomorrow, Greenspan, a Republican whose 18-year tenure as head of the US Federal Reserve was widely admired, will also deliver a stinging critique of President George W Bush’s economic policies.

However, it is his view on the motive for the 2003 Iraq invasion that is likely to provoke the most controversy. “I am saddened that it is politically inconvenient to acknowledge what everyone knows: the Iraq war is largely about oil,” he says.

Greenspan, 81, is understood to believe that Saddam Hussein posed a threat to the security of oil supplies in the Middle East.

Britain and America have always insisted the war had nothing to do with oil. Bush said the aim was to disarm Iraq of weapons of mass destruction and end Saddam’s support for terrorism.

Gates rejects Greenspan claim war is about oil

By Thomas Ferraro 1 hour, 29 minutes ago

WASHINGTON (Reuters) - U.S. Defense Secretary Robert Gates on Sunday rejected former Federal Reserve Chairman Alan Greenspan's statement that the Iraq war "is largely about oil."

With Democratic lawmakers apparently short of the votes needed to force President George W. Bush to change course, Gates defended the war, now in its fifth year, and said it's being driven by the need to stabilize the Gulf and put down hostile forces.

Gates's defense came a day after thousands of anti-war protesters marched in Washington. A spokeswoman for one of the groups who organized the march said more than 200 protesters were taken into custody, including at least 10 Iraq war veterans, when they attempted to cross a police barrier near the U.S. Capitol.

Greenspan, in his new book, "The Age of Turbulence: Adventures in a New World," echoed long-held complaints of many critics that a key motivating force in the war is to maintain U.S. access to the rich oil supplies in Iraq.

"Whatever their publicized angst over Saddam Hussein's 'weapons of mass destruction,' American and British authorities were also concerned about violence in an area that harbors a resource indispensable for the functioning of the world economy," Greenspan wrote.

"I'm saddened that it is politically inconvenient to acknowledge what everyone knows: The Iraq war is largely about oil," added Greenspan, who for decades had been one of the most respected U.S. voices on fiscal policies.

After more than 18 years at the helm, Greenspan retired in January 2006 as chairman of the Fed, the nation's central bank, which regulates monetary policy.

Appearing on ABC's "This Week," Gates said, "I have a lot of respect for Mr. Greenspan." But he disagreed with his comment about oil being a leading motivating factor in the war.

"I wasn't here for the decision-making process that initiated it, that started the war," Gates said. But he added, "I know the same allegation was made about the Gulf War in 1991, and I just don't believe it's true."

"I think that it's really about stability in the Gulf. It's about rogue regimes trying to develop weapons of mass destruction. It's about aggressive dictators," Gates said.

"After all, Saddam Hussein launched wars against several of his neighbors," Gates said. "He was trying to develop weapons of mass destruction, certainly when we went in, in 1991."

Bush last week ordered gradual troop reductions in Iraq into next summer but defied calls for a dramatic change of course, saying the U.S. military role there will stretch beyond his presidency.

Gates said he would urge Bush to veto a proposal by Democratic Sen. James Webb of Virginia that would require U.S. troops spend as much time at home as their previous tour in Iraq.

"It would be extremely difficult for us to manage that," Gates said. "It really is a backdoor way to try and force the president to accelerate the drawdowns. Again, the drawdowns have to be based on the conditions on the ground."

Senate Armed Services Committee Chairman Carl Levin, a Michigan Democrat, said he did not know if the Senate, held by Democrats, 51-49, would be able to muster the 60 votes needed to clear a Republican procedural roadblock and approve the Webb measure. But he said "it has a good chance."

He conceded, however, that at this point backers do not have the two-thirds majority that would be needed to override a Bush veto of the legislation.

"But that doesn't mean we shouldn't fight for what we believe in just because the president may veto it," Levin said on CBS's "Face the Nation."

"I think there's enough Republicans who believe we've got to change course but whether they'll vote that way, we just simply don't know," Levin said.

(Additional reporting by David Wiessler, Mark Felsenthal and Doug Palmer)

Thursday, September 13, 2007

A pub turns into club

McKinney: The Londoner got around loss of alcohol license12:00 AM CDT on Thursday, September 13, 2007

By ROY APPLETON / The Dallas Morning Newsrappleton@dallasnews.com

McKINNEY – Order and purpose have returned to 100 N. Tennessee St. All again goes with the flow.

For as the banner flying Tuesday over McKinney put it: "The Londoner Is Open!!"

Three months after losing its state license to sell alcoholic beverages, the popular pub is back as a private club – with a little help from some friends.

Since its opening four-plus years ago, the place has become a gathering spot and energy hub for downtown McKinney, creating some night life and, as alcohol sources can do, occasionally some work for police.

It has drawn a loyal following (as well as a Guinness and more) with its fish and chips, dartboards, jukebox and mother-country public house look and feel.

"You walk in here a stranger, and by the end of the night you've got a roomful of friends," said Lucy Parker Watkins, a regular who often brings her two daughters in for meals and playful company.

And in recent months, an outpouring of public support has helped the pub through dry and uncertain times.

In May 2004, McKinney voters decided restaurants could sell mixed drinks and other alcoholic beverages, as long as alcohol sales provide no more than half of their revenue.

But in June, the Texas Alcoholic Beverage Commission declined to renew the Londoner's mixed-drink permit after the business attributed 61 percent of its previous year's revenue to alcohol.

Facing a yearlong wait to reapply for the permit, the pub's owner applied to sell alcohol as a private club.

For a spell, the restaurant gave away beer and wine to keep its spirit alive – a short-lived offer that became too popular and costly. Loyalists' appetites and tips helped keep the doors open, as did profits from the Londoner's sister pub in Addison. Some employees hung in with pay cuts.

And when the city staff opposed the Londoner's private club plan, its die-hards responded with signs, petitions and words of support to the City Council.

Besides a state license, McKinney also requires that private clubs obtain a council-approved specific-use permit.

The city planning staff recommended denial of the Londoner's permit because of "general concern over the number and severity of police calls" there, said Melissa Henderson, city planning director.

Since 2005, McKinney police have responded to 10 alcohol-related disturbances inside or near the Londoner, including five cases of public intoxication and three fights, said Capt. Randy Roland, a police spokesman.

"It's the type of calls we were seeing that caused concern," he said, explaining why Police Chief Doug Kowalski proposed denial of the permit.

"They were acting like a bar. That's why they lost their state license," Capt. Roland said. "Our attempt was to raise the red flag. ... The chief said we'd rather not have bars, but if you want them, we'll police them."

Any problem or police call is unfortunate, said Barry Tate, the Londoner's Texas-born, England-bred general manager. But trouble can happen wherever alcohol is served, he said, particularly after 9 p.m.

"You can't watch everyone," he said. Still, 10 disturbances in going on three years are, relatively speaking, "nothing," he said.

As the Londoner's request came to a head, about 750 people signed a petition supporting it. Some posted storefront signs or praised the Londoner before the council and its advisory planning and zoning commission.

And after the council's unanimous OK on Sept. 4, adult beverages returned to the two-story brick building, circa 1890, at the southeast corner of the square.

"We can't thank them enough for what they've done," Marie Briton, the Londoner's manager, said of the pub's champions, who won't see much change in the revived operation.

State law requires that a private club's patrons be members of the establishment. But the serving of alcoholic beverages is otherwise no different than at other types of bars or restaurants. And the city permit now requires that the Londoner derive at least 35 percent of its revenues from food sales.

"We just have to scan the driver's license and they are a member for a year," said Ms. Briton, who, like her boss, is a transplant from England.

Mayor Bill Whitfield said he welcomed the Londoner's public show of support but added that the council probably would have supported the pub anyway.

"I don't think the picture is as bad" as presented, the mayor said, of the police department's concerns.

The Londoner "serves a purpose," he said, in helping enliven a city core that has been rich in antique, clothing and knickknack shops – but now includes a broadening array of restaurants and 12 businesses selling alcoholic beverages.

"It's a meeting place, a place you know you can find people," said Gerhard Deffner, a downtown resident who pulled the Londoner banner behind his airplane this week.

Several downtown merchants said worries about fights and drunks are overblown.

"There is no bar atmosphere" downtown, said Brian Keffer, manager of Landon Winery at the southwest corner of the square.

"They are bringing in diversity," he said of the Londoner. "The city should approve."

Wednesday, September 12, 2007

Wed Sep 12, 2007 2:14 PM EDT

(Page 1 of 2)

By Richard Valdmanis

NEW YORK (Reuters) - Crude oil prices vaulted to a record high $80 a barrel on Wednesday as dealers focused on tight inventories in top consumer the United States ahead of peak winter demand.

A rash of fires at BP's oil fields in Alaska's North Slope added to the record run, though BP said the accidents had minimal impact to production that was already being curtailed by routine maintenance.

The surge in oil prices came a day after OPEC agreed to a small production hike in an effort to soothe consumer nations' fears that soaring crude costs could slow economic growth.

"The OPEC outcome was not enough of a shocker to turn around a market that likes to read extremes," said Olivier Jakob of oil consultancy Petromatrix.

U.S. light crude for October delivery was up $1.59 at $79.82 per barrel at 2:07 p.m. EDT after setting a record high of $80.00 a barrel earlier. London Brent crude was up $1.35 at $77.73 a barrel.

Crude oil stocks in top consumer the United States fell 7.1 million barrels last week to their lowest level in eight months ahead of the winter heating season, according to the U.S. Energy Information Administration.

Analysts had expected a fall of 2.4 million barrels.

"The reality is that the crude tightness in Europe and Asia has begun to affect the U.S. market in a big way," said Antoine Halff, analyst at Fimat Research in New York. "In retrospect, it validates OPEC's decision to increase production."

Heating oil futures prices also struck a record Wednesday of $2.2139 a gallon, up 3.12 cents.

Experts said OPEC's deal in Vienna Tuesday to raise output by a half a million barrels per day starting November 1 was not enough to reverse rising energy prices.

"It legitimises the excess production that was there relative to OPEC's previous implied quota and not much more," said Harry Tchilinguirian, senior oil market analyst at BNP Paribas. Continued ...

http://ca.today.reuters.com/news/new...archived=False

Tuesday, September 11, 2007

By SUZANNE GAMBOA, Associated Press Writer

1 hour, 33 minutes ago

The Senate voted Tuesday to ban Mexican trucks from U.S. roadways, rekindling a more than decade-old trade dispute with Mexico.

By a 74-24 vote, the Senate approved a proposal by Sen. Byron Dorgan, D-N.D., prohibiting the Transportation Department from spending money on a North American Free Trade Agreement pilot program giving Mexican trucks access to U.S. highways.

The proposal is part of a $106 billion transportation and housing spending bill that the Senate hopes to vote on later this week. The House approved a similar provision to Dorgan's in July as part of its version of the transportation spending bill.

Supporters of Dorgan's amendment argued the trucks are not yet proven safe. Opponents said the U.S. is applying tougher standards to Mexican trucks than to Canadian trucks and failing to live up to its NAFTA obligations.

Until last week, Mexican trucks were restricted to driving within a commercial border zone that stretched about 20 miles from the U.S.-Mexican boundary, 75 miles in Arizona. One truck has traveled deep into the U.S. interior as part of the pilot program.

Blocking the trucks would help Democrats curry favor with organized labor, an important ally for the 2008 presidential elections.

"Why the urgency? Why not stand up for the (truck) standards that we've created and developed in this country?" Dorgan asked.

Sen. John Cornyn, R-Texas, who drafted a Republican alternative to Dorgan's amendment, said the attempt to block the trucks appeared to be about limiting competition and may amount to discrimination against Mexico.

"I would never allow an unsafe truck on our highways, particularly Texas highways," he said.

Under NAFTA, Mexico can seek retaliation against the U.S. for failing to adhere to the treaty's requirements, including retaining tariffs on goods that the treaty eliminates, said Sidney Weintraub, a professor emeritus at the University of Texas LBJ School of Public Affairs in Austin.

The trucking program allows up to 100 Mexican carriers to send their trucks on U.S. roadways for delivery and pickup of cargo. None can carry hazardous material or haul cargo between U.S. points.

So far, the Department of Transportation has granted a single Mexican carrier, Transportes Olympic, access to U.S. roads after a more than decade-long dispute over the NAFTA provision opening up the roadways.

One of the carrier's trucks crossed the border in Laredo, Texas last week and delivered its cargo in North Carolina on Monday and was expected to return to Mexico late this week after a stop in Decatur, Ala.

The transportation bill is S. 1789.

http://news.yahoo.com/s/ap/20070911/...nS kmJ_eMwfIE

Monday, September 10, 2007

| |

By Mike Whitney

Online Journal Contributing Writer

Sep 10, 2007, 01:25

Email this article

Printer friendly page

“The new capitalist gods must love the poor -- they are making so many more of them.” Bill Bonner, “The Daily Reckoning”

“The hope of every central bank is that the real problem can be kept from public view. The truth is that the public -- even professionals on Wall Street -- have no clue what the real problem is. They know it has something to do with derivatives, but none of them realize that it’s more than a $20 trillion mountain of unfunded, unregulated paper that has just been discovered to not have a market and, therefore, no real value . . . When the dollar realizes the seriousness of the situation -- be that now or sometime soon -- the bottom will drop out.” --Jim Sinclair, Investment analyst

About a month ago, I wrote an article “Stock Market Brushfire: Will there be a run on the banks?” which showed how the collapse in the housing market and the deterioration in mortgage-backed bonds (CDOs) in the secondary market was creating difficulties for the banking system. Now these problems are becoming more apparent.

From the Wall Street Journal: “The rising interbank lending rates are a proxy of sorts for the increased risk that some banks, somewhere, may go belly up.” (Editorial; WSJ, 9-6-07)

Ironically, the WSJ editorial staff -- which normally defends deregulation and laissez faire economics "tooth-n-nail" -- is now calling for regulators to make sure they are “on top of the banks they are supposed to be regulating, so we don’t get any surprise bank failures that spook the markets and confirm the worst fears being whispered about.”

“Surprise bank failures?”

Henry Liu sums it up like this in his article, "The Rise of the non-bank system" -- required reading for anyone who wants to understand why a stock market crash is imminent: “Banks worldwide now reportedly face risk exposure of US$891 billion in asset-backed commercial paper facilities (ABCP) due to callable bank credit agreements with borrowers designed to ensure ABCP investors are paid back when the short-term debt matures, even if banks cannot sell new ABCP on behalf of the issuing companies to roll over the matured debt because the market views the assets behind the paper as of uncertain market value.

"This signifies that the crisis is no longer one of liquidity, but of deteriorating creditworthiness system-wide that restoring liquidity alone cannot cure. The liquidity crunch is a symptom, not the disease. The disease is a decade of permissive tolerance for credit abuse in which the banks, regulators and rating agencies were willing accomplices." (Henry Liu,”The Rise of the Non-bank System,” Asia Times)

That's right; nearly $1 trillion in worthless paper is clogging the system, putting the kibosh on the big private equity deals and spreading panic through the money markets. It's a slow-motion train wreck and there's not a thing the Fed can do about it.

This isn't a liquidity problem that can be fixed by lowering the Fed's fund rate and creating more easy credit. This is a solvency crisis; the underlying assets upon which this world of "structured finance" is built have no established market value, therefore -- as Jim Sinclair suggests -- they're worthless. That means that the trillions of dollars which have been leveraged against these shaky assets -- in the form of credit default swaps (CDSs) and numerous other bizarre-sounding derivatives -- will begin to cascade down wiping out trillions in market value.

How serious is it? Economist Liu puts it like this: "Even if the Fed bails out the banks by easing bank reserve and capital requirements to absorb that massive amount, the raging forest fire in the non-bank financial system will still present finance capitalism with its greatest test in eight decades."

Overview

Credit standards are tightening and banks are increasingly reluctant to lend money to each other not knowing who may be sitting on billions of dollars in toxic mortgage-backed debt. (Collateralized debt obligations) It makes no difference that the “underlying economy is sound” as Bernanke likes to say. When banks hesitate to lend money to each other; it shows that there is real uncertainty about the solvency of the other banks. It slows down commerce and the gears on the economic machine begin to rust in place.

The banks' woes have been exacerbated by the flight of investors from money market funds, many of which are backed by Mortgage-backed Securities (MBS). Wary investors are running for the safety of US Treasuries even though yields that have declined at a record pace. This is causing problems in the Commercial Paper market as well as for the lesser known SIVs and “conduits.” These abstruse sounding investment vehicles are the essential plumbing that maintains normalcy in the markets. Commercial paper is a $2.2 trillion market. When it shrinks by more than $200 billion -- as it has in the last three weeks -- the effects can be felt through the entire system.

The credit crunch has spread across the whole gamut of commercial paper and low-grade debt. Banks are hoarding cash and refusing loans to even creditworthy applicants. The collapse in subprime loans is just part of the story. More than 50 percent of all mortgages in the last two years have been unconventional loans -- no down payment, no verification of income, “no doc,” interest-only, negative amortization, piggyback, 2-28s, teaser rates, adjustable rate mortgages (ARMs). All of these reflect the shoddy lending standards of the past few years and all are contributing to the unprecedented rate of defaults. Now the banks are holding $300 billion of these "unmarketable" mortgage-backed CDOs and another $200 billion in equally-suspect CLOs. (Collateralized loan obligations; the CDOs corporate-twin).

Even more worrisome, the large investment banks have myriad “off-book” operations which are in distress. This has forced the banks to circle the wagons and reduce their issuance of loans, which is accelerating the downturn in housing. Typically, housing bubbles unwind very slowly over a five- to 10-year period. That won’t be the case this time. The surge in inventory, the financial distress of many homeowners and the complete breakdown in loan-origination (due to the growing credit crunch) ensures that the housing market will crash-land sometime in late 2008 or early 2009. The banks are expected to write-off a considerable portion of their CDO-debt at the end of the 3rd quarter rather than keep the losses on their books. This will further hasten the decline in housing prices.

The banks are also suffering from the sudden sluggishness in leveraged buyouts (LBOs). Credit problems have slowed private equity deals to a dribble. In July, there were $579 billion in LBOs. In August, that number shrank to a paltry $222 billion. In September, those figures will deteriorate to double digits. The big deals aren’t getting done and debt is not rolling over. More than $1 trillion in debt will have to be refinanced in the next five weeks. In the present climate, that doesn’t look likely. Something’s has got to give. The market has frozen and the Fed’s $60 billion repo-lifeline has done nothing to help.

In the first seven months of 2007, LBOs accounted for “$37 of every $100 spent on deals in the US.”

Thirty-seven percent! How will the financial giants make up for the windfall profits that these deals generated?

Answer: They won’t. Just as they won’t make up for the enormous origination fees they made from “securitizing” mortgages and selling them off to credulous pension funds, insurance companies and foreign banks.

As Steven Rattner of DLJ Merchant Banking said, “It’s become nearly impossible to finance a private equity transaction of over $1 billion.” (WSJ) The Golden Era of Acquisitions and Mega-mergers is coming to an end. We can expect that the financial giants will probably follow the same trajectory as the dot-coms following the 2001 NASDAQ rout.

The investment banks are also facing enormous potential losses from liabilities that “operate off their balance sheets” In David Reilly’s article, “Conduit Risks are hovering over Citigroup” (WSJ 9-5-07), Reilly points out that “banks such as Citigroup Inc. could find themselves burdened by affiliated investment vehicles that issue tens of billions of dollars in short-term debt known as commercial paper . . . Citigroup, for example, owns about 25 percent of the market for SIVs, representing nearly $100 billion of assets under management. The largest Citigroup SIV is Centauri Corp., which had $21 billion in outstanding debt as of February 2007, according to a Citigroup research report. There is no mention of Centauri in its 2006 annual filing with the Securities and Exchange Commission.

"Yet some investors worry that if vehicles such as Centauri stumble, either failing to sell commercial paper or suffering severe losses in the assets it holds, Citibank could wind up having to help by lending funds to keep the vehicle operating or even taking on some losses."

So, many investors don’t know that Citigroup could be holding the bag for “$21 billion in outstanding debt”? Or, perhaps, the entire $100 billion is red ink; who knows? (Citigroup’s stock dropped by more than 2 percent after this report appeared in the WSJ.)

Another report, which appeared in CNN Money, further adds to the suspicion that the banks’ “brokerage affiliates” may be in trouble: “The Aug. 20 letters from the Fed to Citigroup and Bank of America state that the Fed, which regulates large parts of the U.S. financial system, has agreed to exempt both banks from rules that effectively limit the amount of lending that their federally-insured banks can do with their brokerage affiliates. The exemption, which is temporary, means, for example, that Citigroup's Citibank entity can substantially increase funding to Citigroup Global Markets, its brokerage subsidiary. Citigroup and Bank of America requested the exemptions, according to the letters, to provide liquidity to those holding mortgage loans, mortgage-backed securities, and other securities . . . This unusual move by the Fed shows that the largest Wall Street firms are continuing to have problems funding operations during the current market difficulties.” (CNN Money)

Does this mean that the other large banks are involved in the same type of “hide-n-seek” strategies? Sounds a lot like Enron’s “off-the-books” shenanigans, doesn’t it?

Wall Street Journal: “'Any off-balance-sheet issues are traditionally poorly disclosed, so to some extent, you're dependent on the insight that management is willing to provide you and that, frankly, is very limited,' says Mark Fitzgibbon, director of research at Sandler O'Neill & Partners. ' . . . Accounting rules don’t require banks to separately record anything related to the risk that they will have to loan the entities money to keep them functioning during a markets crisis. . . . The vehicles [SIVs and conduits] are often established in a tax haven and are run solely for investment purposes as opposed to typical corporate activities.'”

Still think the banks are on solid ground?

“Citigroup, the nation's largest bank as measured by market value and assets. Its latest financial results showed that it administers off-balance-sheet, conduit vehicles used to issue commercial paper that have assets of about $77 billion.

"Citigroup is also affiliated with structured investment vehicles, or SIVs that have 'nearly $100 billion' in assets, according to a letter Citigroup wrote to some investors in these vehicles last month.” (IBID)

Yes, and how many of these “assets” are in fact corporate debt, auto loans, credit card debt, and student loans that have been securitized and are now under extreme pressure in a slumping market?

In an “up market” loans can provide a valuable income stream that transforms someone else’s debt into a valuable asset. In a "down market," however, defaults can wipe out trillions in market capitalization overnight.

How did we get into this mess?

More than 20 years of dogged lobbying from the financial industry paid off with the repeal of the Glass-Steagall Act, which was passed by Congress following the 1929 stock market crash. The bill was written to limit the conflicts of interest when commercial banks are permitted to underwrite stocks or bonds.

The financial industry whittled away at Glass-Steagall for years before finally breaking down its regulatory restrictions in August 1987, when Alan Greenspan -- formerly a director of J.P. Morgan and a proponent of banking deregulation -- became chairman of the Federal Reserve Board.

“In 1990, J.P. Morgan became the first bank to receive permission from the Federal Reserve to underwrite securities, so long as its underwriting business does not exceed the 10 percent limit. In December 1996, with the support of Chairman Alan Greenspan, the Federal Reserve Board issued a precedent-shattering decision permitting bank holding companies to own investment bank affiliates with up to 25 percent of their business in securities underwriting (up from 10 percent).

"This expansion of the loophole created by the Fed's 1987 reinterpretation of Section 20 of Glass-Steagall effectively rendered Glass-Steagall obsolete.” (“The Long Demise of Glass Steagall, Frontline, PBS)

In 1999, after 25 years and $300 million of lobbying efforts, Congress, aided by President Bill Clinton, finally repealed Glass-Steagall. This paved the way for the problems we are now facing.

Another contributing factor to the current banking-muddle is the Basel rules. According to the BIS (Bank of International Settlements) website: “The Basel Committee on Banking Supervision provides a forum for regular cooperation on banking supervisory matters. Its objective is to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide. It seeks to do so by exchanging information on national supervisory issues, approaches and techniques, with a view to promoting common understanding. At times, the Committee uses this common understanding to develop guidelines and supervisory standards in areas where they are considered desirable. In this regard, the Committee is best known for its international standards on capital adequacy; the Core Principles for Effective Banking Supervision; and the Concordat on cross-border banking supervision.”

The Basel Committee on Banking (Basel 2) requires “banks to boost the capital they hold in reserve against the loans on their books.”

Sounds like a good thing, doesn’t it? This protects the overall financial system as well as the individual depositor. Unfortunately, the banks found a way to circumvent the rules for minimum reserves by “securitizing” pools of mortgages (MBS) rather than holding individual mortgages. (which called for more reserves) This provided lavish origination and distribution fees for banks, but shifted much of the risk of default to Wall Street investors. Now, the banks are saddled with roughly $300 billion in mortgage-backed debt (CDOs) that no one wants and it is uncertain whether they have sufficient reserves to cover their losses.

By October, we should know how this will all play out. As David Wessel points out in “New Bank Capital requirements helped to Spread Credit Woes”: “Banks now behave more like securities firms, more likely to mark down the value of assets when market prices fall -- even to distressed levels -- rather than sitting on bad loans for a decade and pretending they’ll be paid back.”

The downside of this is that once that banks write off these toxic MBSs and CDOs; the hedge funds, insurance companies and pension funds will be forced to do the same -- dumping boatloads of this bond-sludge on the market, driving down prices and triggering a panic sell-off. This is what the Fed is trying to prevent through its $60 billion repo-bailout.

Regrettably, the Fed cannot hope to remove a half-trillion dollars of bad debt from the balance sheets of the banks or forestall the collapse of related financial institutions and funds which are loaded with these “unmarketable” time-bombs. Besides, most of the mortgage derivatives (CDOs) have been massively enhanced with low interest leverage from the “carry trade.” When the value of these CDOs is finally determined -- which we expect will happen sometime before the end of the 3rd quarter -- we can expect the stock market to fall sharply and the housing recession to turn into a full-blown economic crisis.

Alan Greenspan: The Fifth Horseman?

So, who’s to blame? The finger pointing has already begun and more and more people are beginning to see how this massive economy-busting equity bubble originated at the Federal Reserve -- it is the logical corollary of former Fed chief Alan Greenspan's “easy money” policies.

Henry C K Liu sums up Greenspan’s tenure at the Fed in his Asia Times article, “Why the Subprime Bust Will Spread”: “Greenspan presided over the greatest expansion of speculative finance in history, including a trillion-dollar hedge-fund industry, bloated Wall Street-firm balance sheets approaching $2 trillion, a $3.3 trillion repo (repurchase agreement) market, and a global derivatives market with notional values surpassing an unfathomable $220 trillion.

"On Greenspan's 18-year watch, assets of US government-sponsored enterprises (GSEs) ballooned 830 percent, from $346 billion to $2.872 trillion. GSEs are financing entities created by the US Congress to fund subsidized loans to certain groups of borrowers such as middle- and low-income homeowners, farmers and students. Agency mortgage-backed securities (MBSs) surged 670 percent to $3.55 trillion. Outstanding asset-backed securities (ABSs) exploded from $75 billion to more than $2.7 trillion.”

"The greatest expansion of speculative finance in history." That says it all.

But no one makes the case against Greenspan better than Greenspan himself. Here are some of his comments at the Federal Reserve System’s Fourth Annual Community Affairs Research Conference, Washington, D.C., April 8, 2005. They show that Greenspan “rubber stamped” every one of the policies which have since metastasized and spread through the entire US economy.

Greenspan, Champion of Subprime loans: “Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country. With these advance in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers.”

Greenspan, Main Proponent of Toxic CDOs: “The development of a broad-based secondary market for mortgage loans also greatly expanded consumer access to credit. By reducing the risk of making long-term, fixed-rate loans and ensuring liquidity for mortgage lenders, the secondary market helped stimulate widespread competition in the mortgage business. The mortgage-backed security helped create a national and even an international market for mortgages, and market support for a wider variety of home mortgage loan products became commonplace. This led to securitization of a variety of other consumer loan products, such as auto and credit card loans.”

Greenspan, Supporter of Loans to People with Bad Credit: “Where once more marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately.

"These improvements have led to the rapid growth in subprime mortgage lending . . . fostering constructive innovation that is both responsive to market demand and beneficial to consumers.

“Improved access to credit for consumers, and especially these more-recent developments, has had significant benefits.

Unquestionably, innovation and deregulation have vastly expanded credit availability to virtually all income classes. Access to credit has enabled families to purchase homes, deal with emergencies, and obtain goods and services. Home ownership is at a record high, and the number of home mortgage loans to low- and moderate-income and minority families has risen rapidly over the past five years. Credit cards and installment loans are also available to the vast majority of households”

Greenspan, Big Fan of “Structural Changes” Which Increase Consumer Debt: "As we reflect on the evolution of consumer credit in the United States, we must conclude that innovation and structural change in the financial services industry have been critical in providing expanded access to credit for the vast majority of consumers, including those of limited means. Without these forces, it would have been impossible for lower-income consumers to have the degree of access to credit markets that they now have.

"This fact underscores the importance of our roles as policymakers, researchers, bankers, and consumer advocates in fostering constructive innovation that is both responsive to market demand and beneficial to consumers.”

Greenspan’s own words are the most powerful indictment against him. They show that he played a central role in our impending disaster. The effort on the part of media pundits, talking heads, and so-called experts to foist the blame on the rating agencies, predatory lenders or gullible mortgage applicants misses the point entirely. The problems began at the Federal Reserve and that’s where the responsibility lies.

Thursday, September 06, 2007

“The Art of Nature” Art Debut at Carrie Garner’s

Galleria d’Arte

Fed injects 31.25 billion dollars into markets

Sep 6 11:01 AM US/Eastern

The Federal Reserve added 31.25 billion dollars in temporary reserves to the US money markets Thursday in three different operations, the latest move to keep credit markets from drying up.

The New York Fed added 7.0 billion dollars in 14-day repurchase agreements, 16 billion in seven-day repurchase agreements and 8.25 billion in one-day repos.

The Fed has injected some 200 billion dollars into the financial system since August 9 in a bid to boost credit flows which have seized up due to problems linked to the distressed US mortgage market.

The US central bank typically buys billions of dollars worth of securities from major banks, pumping extra cash into the banking system, which the banks are obliged to repurchase at a later date.

http://www.breitbart.com/print.php?i...show_article=1

than at any other time of the year. It triggers us to reflect

on what has been and what is yet to come. This enchanting

light magically brings us insight into our past and fills

us with yearning to grasp the future with more awareness.

exploration of beauty and nature.

Tuesday, September 04, 2007

Monday, September 03, 2007

Felix is a Cat 5 Hurricane!

Satellite images depicted some warming of the cloud

tops which could be indicative of slight weakening.

A NOAA reconnaissance plane measured 162 kt winds

around 11z which would still support 145 kt at the surface.

However subsequent to that observation the central

pressure has risen a bit and the eye is not as well defined on

visual imagery. So the current intensity is adjusted downward

slightly...to 140 kt. Fluctuations in strength due to inner

core processes are typical in intense hurricanes. There has

not been much evidence of concentric eyewalls or an eyewall

replacement thus far but such an event could occur...and it

would have an influence on the intensity of Felix. However

these eyewall cycles are difficult to time or to predict.

The large scale environment... in terms of wind shear and

oceanic heat content...should remain conducive to the

maintenance of Cat 4/5 intensity until interaction with land.

The forecast intensity at 36 hours and beyond is highly

uncertain because it depends on the track of the center with

respect to the land mass of Central America and Mexico.

Clearly if Felix moves more to the right of our forecast it

will remain stronger and if it moves to the left of the NHC

track it would be much weaker. Indeed...if the cyclone fails

to emerge over the Bay of Campeche...it could dissipate before

the end of the forecas period.Latest fixes show that the fast westward motion...280/18...

continues. The NHC track forecast and synoptic reasoning

are basically unchanged. Global model forecast fields

maintain sufficient mid-tropospheric ridging to the

north of Felix so that...if these forecasts verify...the

tropical cyclone will be unable to gain much latitude

over the next few days. The official track forecast

is similar to the previous one and roughly in the

middle of the guidance envelope.A Hurricane Warning has been issued for portions of northeastern

Nicaragua.Data shows that the central pressure has come up a bit

Sunday, September 02, 2007

Hurricane Felix is kickin ass and takin names!

Felix has rapidly strengthened overnight. An Air Force

reconnaissance aircraft measured maximum flight-level

winds of 93kt and a central pressure of 984 mb during the

last eye penetration at about 0638z. In addition...an

eyewall dropsonde measured surface winds of 85 kt derived

from the mean wind in the lower layer of the sounding.

Based on these data the advisory intensity is set to 85 kt.

While the eye has not yet become discernible in

conventional GOES infrared imagery...it is clearly evident

in radar imagery from Curacao and in passive microwave

imagery from a trmm overpass at 0619z.Felix continues on a path just north of due west or

275/16...with steering provided by a strong deep-layer

ridge over the western Atlantic. This ridge is forecast

by the models to build westward...preventing Felix from

gaining any significant latitude during the next few days.

The track guidance is in good agreement on a continuation

of the current motion for the next 48-72 hours.

Even the NOGAPS...an earlier northern outlier...has shifted

south and back into the rest of the guidance envelope.

Beyond 72 hours...the models take various paths across Central

America...with the most southern solution provided by the GFDL.

The new official forecast is adjusted just slightly to the

south...mostly to account for the initial motion. The forecast

at 4-5 days is rather uncertain and depends on just how much

ridging is present over the Gulf of Mexico at that time.All factors point to continued intensification...and

the new official forecast is adjusted upward mainly to

reflect the overnight strengthening just observed...and

so is higher than most of the objective guidance. Felix

appears on its way to becoming a major hurricane over the

Caribbean...but how much land it traverses beyond 48 hours

makes the long-range intensity forecast very uncertain.

Saturday, September 01, 2007

BULLETIN

TROPICAL STORM FELIX INTERMEDIATE ADVISORY NUMBER 3A

NWS TPC/NATIONAL HURRICANE CENTER MIAMI FL AL062007

800 AM AST SAT SEP 01 2007

...FELIX STRENGTHENING IN THE EASTERN CARIBBEAN...

AT 8 AM AST...1200 UTC...THE TROPICAL STORM WARNING FOR ST. VINCENT

AND THE GRENADINES HAS BEEN DISCONTINUED.

A TROPICAL STORM WARNING REMAINS IN EFFECT FOR THE ISLANDS OF

ARUBA...BONAIRE...CURACAO AND FOR GRENADA AND ITS DEPENDENCIES. A

TROPICAL STORM WARNING MEANS THAT TROPICAL STORM CONDITIONS ARE

EXPECTED WITHIN THE WARNING AREA WITHIN THE NEXT 24 HOURS.

A TROPICAL STORM WATCH REMAINS IN EFFECT FOR THE NORTHERN COAST OF

VENEZUELA FROM CUMANA TO PEDERNALES INCLUDING THE ISLAND OF

MARGARITA. A TROPICAL STORM WATCH MEANS THAT TROPICAL STORM

CONDITIONS ARE POSSIBLE WITHIN THE WATCH AREA...GENERALLY WITHIN 36

HOURS.

INTERESTS ELSEWHERE IN THE EASTERN AND CENTRAL CARIBBEAN SEA SHOULD

CLOSELY MONITOR THE PROGRESS OF THIS SYSTEM.

FOR STORM INFORMATION SPECIFIC TO YOUR AREA...INCLUDING POSSIBLE

INLAND WATCHES AND WARNINGS...PLEASE MONITOR PRODUCTS ISSUED

BY YOUR LOCAL WEATHER OFFICE.

AT 800 AM AST...1200Z...THE CENTER OF TROPICAL STORM FELIX WAS

LOCATED NEAR LATITUDE 12.4 NORTH...LONGITUDE 62.8 WEST OR ABOUT 75

MILES...120 KM...WEST-NORTHWEST OF GRENADA.

FELIX IS MOVING TOWARD THE WEST NEAR 18 MPH...30 KM/HR...AND THIS

GENERAL MOTION IS EXPECTED TO CONTINUE DURING THE NEXT 24 HOURS.

ON THIS TRACK...FELIX WILL MOVE FARTHER AWAY FROM THE SOUTHERN

WINDWARD ISLANDS LATER THIS MORNING AND WILL BE PASSING NEAR OR TO

THE NORTH OF THE ISLANDS OF ARUBA...BONAIRE AND CURACAO LATE

TONIGHT OR EARLY SUNDAY MORNING.

MAXIMUM SUSTAINED WINDS HAVE INCREASED AND ARE NOW NEAR 45 MPH...75

KM/HR...WITH HIGHER GUSTS. SOME STRENGTHENING IS FORECAST DURING

THE NEXT 24 HOURS. AN AIR FORCE RESERVE HURRICANE HUNTER AIRCRAFT

IS SCHEDULED TO INVESTIGATE FELIX LATER THIS MORNING.

TROPICAL STORM FORCE WINDS EXTEND OUTWARD UP TO 45 MILES...75

KM...TO THE NORTH FROM THE CENTER. A WIND GUST OF 46 MPH WAS

RECENTLY REPORTED IN BARBADOS AND A WIND GUST OF 44 MPH WAS

OBSERVED IN ST. VINCENT.

THE ESTIMATED MINIMUM CENTRAL PRESSURE FROM SURFACE OBSERVATIONS IS

1004 MB...29.65 INCHES.

FELIX IS EXPECTED TO PRODUCE ADDITIONAL RAINFALL ACCUMULATIONS OF 1

TO 2 INCHES ACROSS THE WINDWARD ISLANDS WITH STORM TOTAL AMOUNTS OF

7 INCHES POSSIBLE. RAINFALL AMOUNTS OF 2 TO 4 INCHES ARE POSSIBLE

OVER COASTAL VENEZUELA AND THE NETHERLANDS ANTILLES ISLANDS OF

ARUBA...BONAIRE AND CURACAO.

REPEATING THE 800 AM AST POSITION...12.4 N...62.8 W. MOVEMENT

TOWARD...WEST NEAR 18 MPH. MAXIMUM SUSTAINED WINDS...45 MPH.

MINIMUM CENTRAL PRESSURE...1004 MB.

THE NEXT ADVISORY WILL BE ISSUED BY THE NATIONAL HURRICANE CENTER AT

1100 AM AST.